Verizon 2025 DBIR: Credential Attacks Still Dominate – A Nok Nok Perspective

Verizon 2025 DBIR: Credential Attacks Still Dominate – A Nok Nok Perspective

The Verizon 2025 Data Breach Investigations Report (DBIR) paints a clear, urgent, and yet familiar picture: password-related attacks remain the number one threat to organizations worldwide. As a leader in passwordless authentication, here at Nok Nok, we see the findings as both a wake-up call and a validation of our mission to move everyone beyond passwords.

Key Findings: Passwords and Credential Abuse Remain Top Risks

The report highlights several critical points regarding the persistence of credential-based attacks:

- Stolen Credentials Are the Primary Entry Point: Credential abuse was the initial vector in 22% of breaches globally, making it the single most common way attackers get in. Attackers aren’t hacking their way in-they’re logging in through the front door using stolen, guessed, or leaked passwords.

- Web Application Attacks Rely on Credentials: A staggering 88% of basic web application attacks involved stolen credentials. This highlights how password reuse and weak password policies continue to undermine security.

- Phishing and Social Engineering Fuel Credential Theft: Phishing accounted for nearly 25% of breaches, and social engineering remains a top tactic for stealing login information. The median time for a user to click a phishing link was just 21 minutes-far faster than most organizations can detect and respond. Yikes!

- Infostealers Target Devices and Credentials: 30% of infostealer-compromised systems were enterprise-managed, but 46% were unmanaged, often personal devices used for work (BYOD). This exposes organizations to credential theft outside their direct control.

- Ransomware and Credentials: Ransomware was present in 44% of breaches, and infostealer logs containing corporate credentials were found in over half of ransomware victims. Credentials are often the first step to a much larger compromise.

Other Notable Trends from the 2025 DBIR

Beyond credential attacks, the DBIR also highlights other significant trends:

- Exploitation of Vulnerabilities: Exploits targeting unpatched edge devices (like VPNs and firewalls) surged by 34%, now accounting for 20% of breaches. Attackers are increasingly automating the exploitation of known and zero-day vulnerabilities.

- Third-Party Breaches: The share of breaches involving third parties doubled to 30%, highlighting the risks in supply chains and partner ecosystems.

- Human Error: Human involvement remains a factor in 60% of breaches, reinforcing the need for user training and better security design.

- Remediation Gaps: Only 54% of vulnerable edge devices were patched, with a median fix time of 32 days-leaving a wide window for attackers.

Why Passwords Remain the Weak Link

The DBIR’s findings confirm what we at Nok Nok have long argued: passwords are fundamentally flawed as a security mechanism. Attackers exploit them because:

- They are easily stolen via phishing, malware, or leaks.

- Users often reuse passwords, at work and at home, across multiple sites.

- Passwords can be guessed, brute-forced, or found in breached databases.

- Device and BYOD risks mean credentials can be compromised outside IT’s visibility.

As the report states, “Credential theft continues to be the key to the kingdom in the majority of breaches. And it’s not slowing down”.

The Path Forward: Passwordless Authentication

For organizations looking to break the cycle, the DBIR offers a clear mandate: move beyond passwords. Here’s how Nok Nok recommends responding:

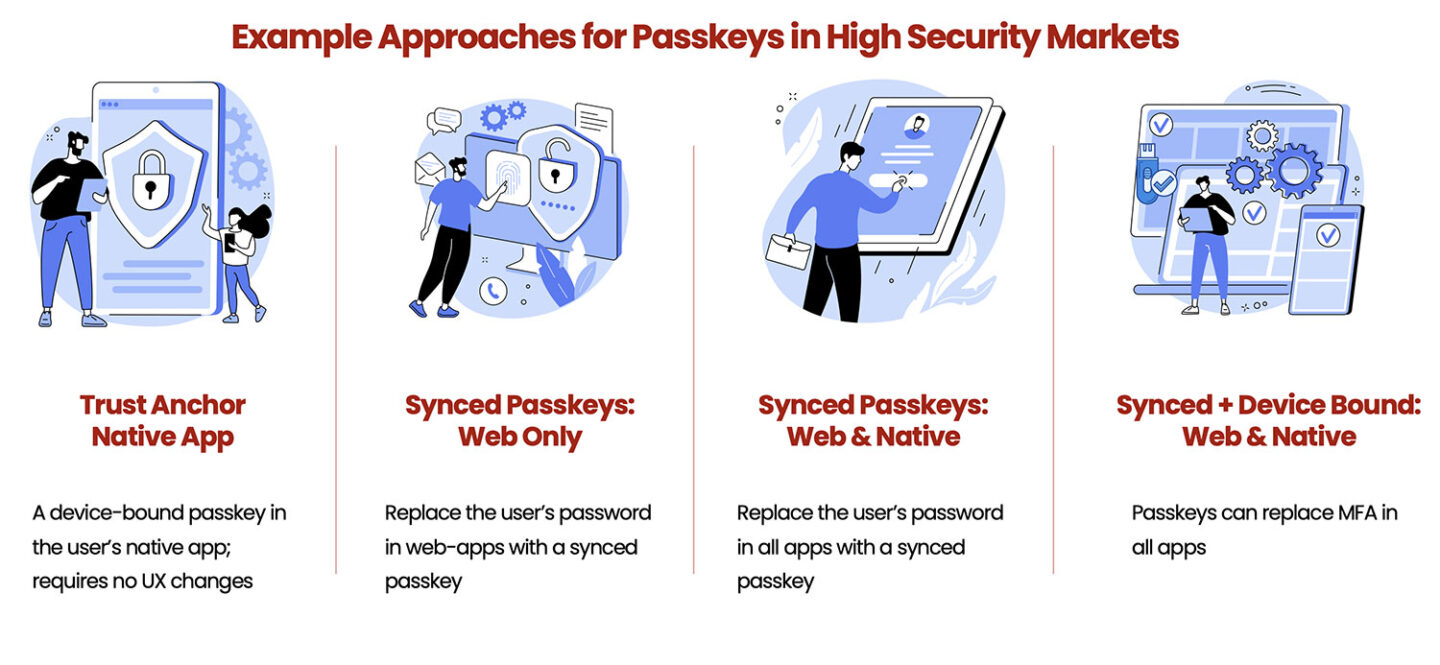

- Adopt Passwordless, Phishing-Resistant Authentication: FIDO-based authentication(aka passkeys) eliminate the risks of credential theft, phishing, and reuse by removing passwords from the equation.

- Enforce Strong Access Controls for Devices: Ensure only managed, secure devices can access sensitive systems-especially in BYOD environments.

- Accelerate Patch Management: Reduce the window for vulnerability exploitation by patching edge devices and VPNs rapidly.

- Invest in User Training and Real-Time Detection: While technology is critical, user awareness and rapid response to phishing remain essential.

Conclusion: The Time to Act Is Now

The 2025 Verizon DBIR makes it clear: attackers are evolving, but they still rely on the same old trick – stealing passwords. Why? Because it’s the least path of resistance. Why spend time hacking when you can just log in instead? As long as organizations depend on passwords, breaches will continue. At Nok Nok, we believe the solution is simple: eliminate passwords, embrace modern authentication, and close the door on credential-based attacks for good. This gets us out of the arms-race and leap-frogs credential based attacks. If you’re attending Kuppinger Cole EIC 2025, our very own Rolf Lindemann, Vice President, Products, will be speaking to this very topic!

The future of security is passwordless. Let’s make 2025 the year we finally leave passwords behind.