Nok Nok Announces Innovative Solutions that Simplify Deploying and Managing Passkeys

New AI-powered functionality will enhance security, user experience, and operational efficiency

Nok Nok Authentication Cloud available through AWS Marketplace

SAN JOSE, Calif., October 9, 2024 — Nok Nok, a leader in passwordless authentication for the world’s largest organizations, today announced new product offerings that can be leveraged with its Nok Nok™ S3 Authentication Suite. With these product releases, Nok Nok introduces significant innovations: Nok Nok Intelligent Credential Detection, Nok Nok Smart Analytics, and Nok Nok Smart Sense. With Nok Nok’s S3 Authentication Suite and Authentication Cloud, organizations can now manage their authentication strategies more efficiently, addressing key challenges deploying passkeys.

In response to the accelerated cyber threat landscape, and the need for optimizing the user experience and improving authentication KPIs, Nok Nok implemented AI to improve efficiency and user experience. These AI-driven features not only detect anomalies indicating elevated fraud risks but also identify deviations in critical authentication KPIs that provide actionable insights. By leveraging AI, Nok Nok significantly reduces the operational effort required to implement modern authentication that delights users while providing robust enterprise protection against current threats including AI generated phishing attacks and deep fakes.

“As enterprises transition from multi-factor authentication to more advanced passkey solutions, they need to provide heightened security and streamlined user experiences,” said Todd Thiemann, Senior Analyst, Enterprise Security Group. “Nok Nok’s AI-driven features are important in addressing the evolving cybersecurity threats while reducing operational complexity for organizations seeking robust, passwordless authentication.” These new innovations include:

- Revolutionizing User Experience with Intelligent Credential Detection

Nok Nok’s new Intelligent Credential Detection method marks a substantial improvement in user experience. This feature automatically prompts the use of credentials available on the specific user device. By enhancing the ability to “prime” or prepare users for the next steps when authenticating, this functionality significantly improves success rates and reduces the time it takes to authenticate. - Empowering Decision-Making with Smart Analytics

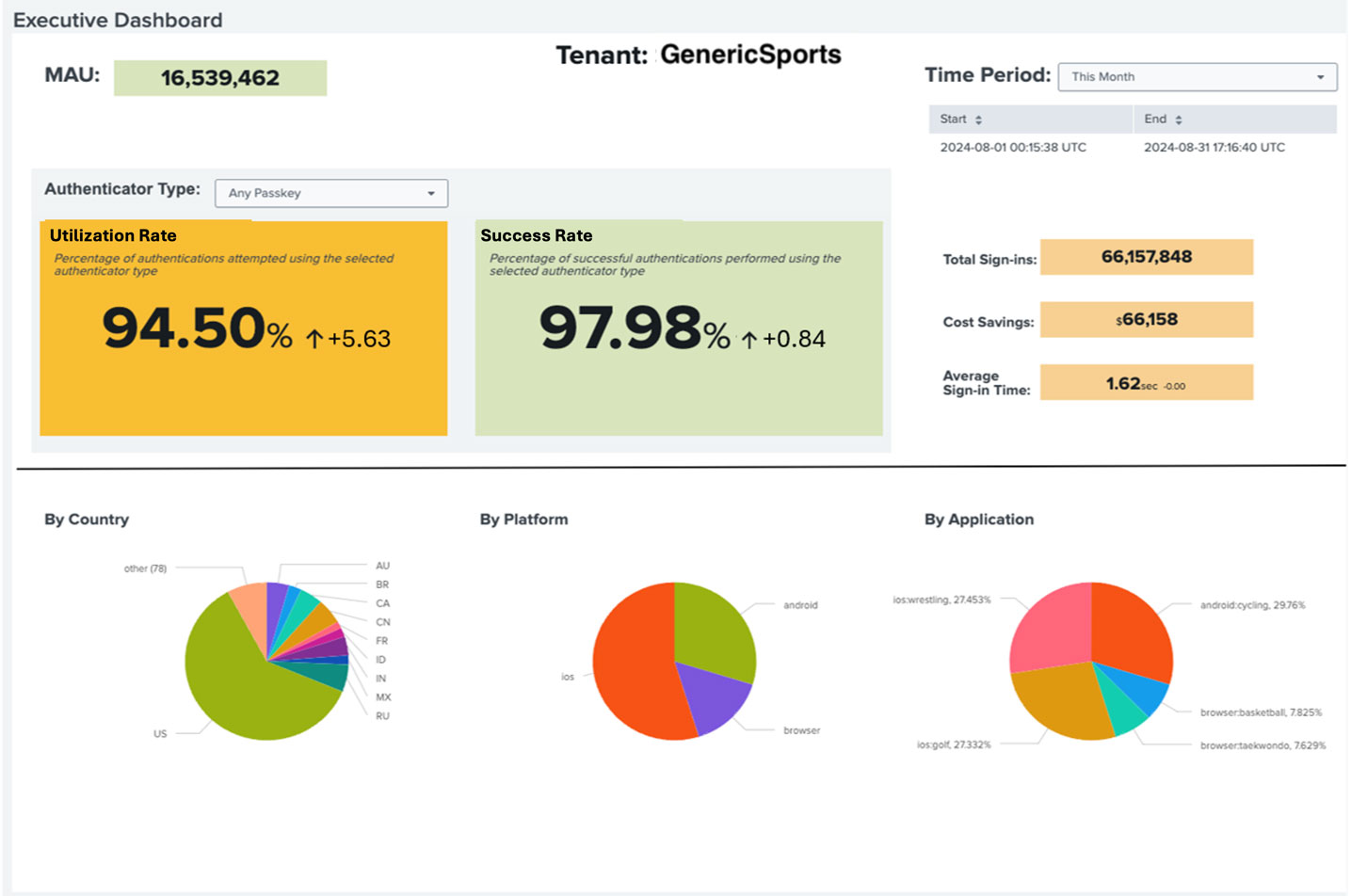

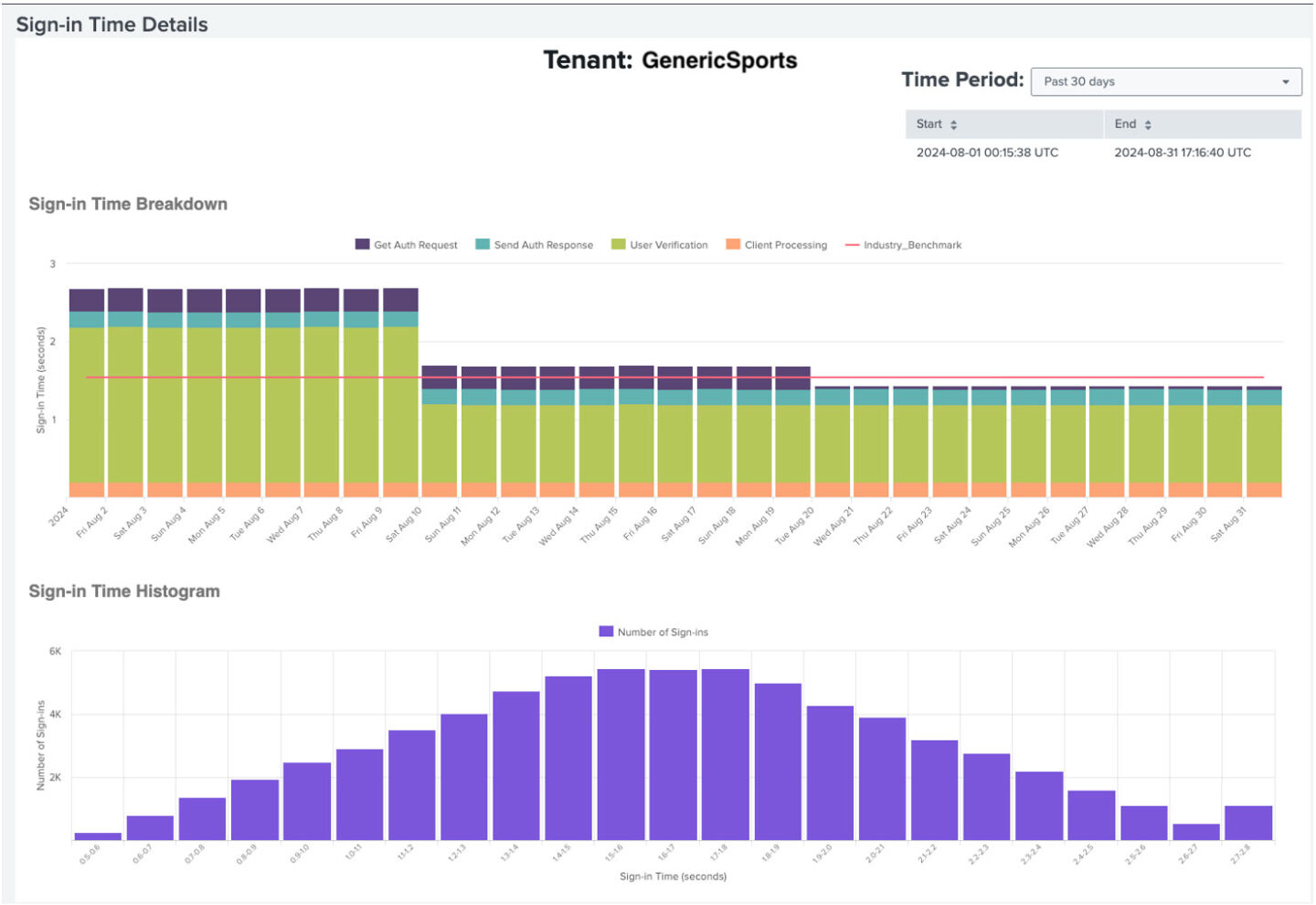

Smart Analytics introduces unprecedented insights into authentication performance. This cloud-based service integrates seamlessly with the S3 Authentication Suite and Nok Nok Authentication Cloud, providing detailed reporting on key performance indicators (KPIs) related to authentication. What sets Smart Analytics apart is its ability to benchmark these KPIs against industry averages and offer actionable suggestions for improvements.

- Enhancing Security with AI-Powered Smart Sense

The introduction of Smart Sense represents Nok Nok’s innovative approach to risk assessment in a passwordless world. Utilizing advanced AI and machine learning algorithms, Smart Sense learns user behavior to provide anomaly scores that can seamlessly be used through the Nok Nok authentication rules engine. This feature is specifically optimized for the passkey ecosystem, helping organizations fine-tune user experiences while enhancing fraud prevention.

These advancements come at a crucial time as organizations worldwide grapple with the challenges of securing and authenticating identities in an increasingly complex threat landscape. Nok Nok’s latest offerings provide a comprehensive solution that addresses the key pain points of implementing and maintaining strong, passwordless authentication.

“For years, Nok Nok has been at the forefront of helping enterprises transition to passkeys, and now with AI-driven innovations, we’re giving our customers powerful tools to make the use of passwordless authentication more intuitive and efficient than ever before,” said Rolf Lindemann, Vice President of Products, Nok Nok. “Our Intelligent Credential Detection streamlines the authentication process by tailoring it to each user’s available credentials, while the new Nok Nok Smart Analytics and benchmarking capabilities provide actionable insights to optimize and enhance user experience. With Nok Nok Smart Sense, we’re also addressing the evolving threat landscape by offering AI-powered, context-aware risk assessments, giving organizations the ability to fine-tune user experiences while bolstering security.”

Streamlined Procurement through AWS Marketplace

To further simplify adoption, Nok Nok also announced that its Authentication Cloud offering is now available through AWS Marketplace. This integration allows organizations to consolidate their ordering and billing processes, making it easier than ever to deploy phishing-resistant authentication using existing AWS budgets.

For more information about Nok Nok’s S3 Authentication Suite and these latest product offerings, visit Nok Nok.

About Nok Nok

Nok Nok is a leader in passwordless customer authentication and delivers the most innovative FIDO (Fast IDentity Online) solutions for the authentication market today. Nok Nok empowers organizations to dramatically improve their user experience and security, and reduce operating expenses, while enabling compliance with the most rigorous privacy and regulatory requirements. The Nok Nok™ S3 Authentication Suite integrates into existing security environments to deliver proven, FIDO-enabled passwordless customer authentication. As a founder of the FIDO Alliance and an innovator of FIDO standards, Nok Nok is an expert in next-level, multi-factor authentication. Nok Nok’s global customers and partners include AFLAC Japan, BBVA, Carahsoft, Fujitsu Limited, Hitachi, Intuit, Mastercard, MUFG Bank, NTT DATA, NTT DOCOMO, Standard Bank, T-Mobile, and Verizon. For more information, https://noknok.com/.

Read the official press release.